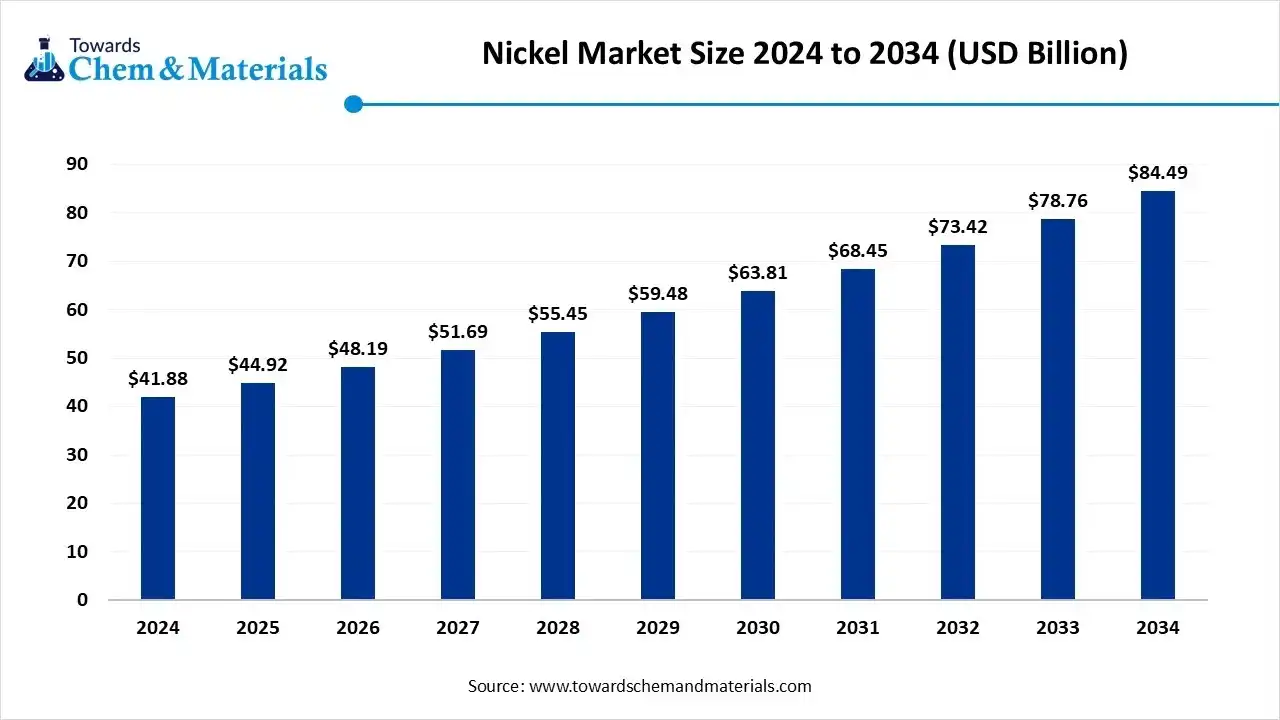

Nickel Market Size to Cross USD 84.49 Billion by 2034

According to Towards Chemical and Materials, the global Nickel market size is calculated at USD 44.92 billion in 2025 and is expected to be worth around USD 84.49 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.27% over the forecast period 2025 to 2034.

Ottawa, Oct. 15, 2025 (GLOBE NEWSWIRE) -- The global nickel market size was valued at USD 41.88 billion in 2024 and is anticipated to reach around USD 84.49 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.27 % over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5888

Nickel Market Overview

The global economy is currently undergoing shifts in national policies, particularly in relation to trade, which are likely to heighten uncertainty across raw materials markets. At its April 2025 meetings, the International Nickel Study Group (INSG) updated its forecasts for the world nickel market, reporting a surplus of 179 thousand tonnes (kt) for 2024. Primary nickel production for the year is estimated at 3.526 million tonnes (Mt), while usage stood at 3.347Mt. Looking ahead to 2025, preliminary figures point to an even larger surplus of 198kt, with output projected to increase to 3.735Mt and demand forecast to reach 3.537Mt.

The nickel market is evolving underpinned by growing reliance on nickel in energy storage and industrial metals. With battery and stainless-steel sectors competing for supply; supply chains are becoming more integrated specially in Asia where downstream refining is being expanded and producers are increasingly focusing on securing battery grade nickel to cater to electric vehicle and renewable energy demand, while managing pressures from oversupply in lower grade nickel forms and regulatory shifts in major producing countries.

Nickel Market Report Highlights

- The Asia Pacific nickel market size was valued at USD 41.88 billion in 2024 and is expected to surpass around USD 84.49 billion by 2034, expanding at a compound annual growth rate (CAGR) of 7.27% over the forecast period from 2025 to 2034.

- By region, Asia Pacific dominated the market by holding approximately 45% share in 2024.

- By product type, the refined nickel segment dominated the market with approximately 60% share in 2024.

- By end-use industry, the stainless-steel production segment held approximately 70% market share in 2024.

Primary nickel production

In 2025, global primary nickel production is projected to grow by 5.9%, following increases of 9.8% in 2023 and 4.9% in 2024.

Asia’s primary nickel production reached 2.842 million tonnes (Mt) in 2024, marking a 9.5% rise, and is forecast to climb to 3.056Mt in 2025 (+7.5%). Indonesia is set to increase output from 1.609Mt to 1.750Mt, thereby consolidating its position as the world’s leading producer, followed by China with respective volumes of 1.029Mt and 1.095Mt. Both countries are expected to expand their production of nickel sulphate and cathode this year. Combined Chinese and Indonesian nickel pig iron (NPI) production is estimated at 1.85Mt in 2024 and is forecast to rise to 1.935Mt in 2025. While China’s NPI output has been in decline since 2019, Indonesia has significantly ramped up production over the past decade. However, the Indonesian government has delayed

the issuance of mining quotas, resulting in supply shortages; as a consequence, some producers have resorted to importing ore from the Philippines to maintain NPI production levels.

Furthermore, discussions took place in Indonesia regarding potential restrictions on new licenses for NPI capacity. At the same time, Indonesian NPI has been exported to European stainless steel (STS) mills for testing as a potential feedstock. All other regions recorded a decline in primary nickel production in 2024, largely as a result of reduced profitability stemming from low nickel prices. In 2025, only Oceania is expected to experience a further contraction of 33.2%, driven by the suspension of BHP’s operations in Australia. Prony Resources resumed operations at its Goro plant in New Caledonia (France) last November, following a six-month suspension due to local unrest. The company produces nickel hydroxide cake (NHC), an intermediate nickel product primarily used in battery manufacturing. European production fell by 0.7% in 2024 but is forecast to recover modestly, with a 3.2% increase in 2025. In the Americas, output contracted by 10.5% in 2024, yet a rebound of 9.6% is anticipated in 2025, supported by rising production in Brazil and Canada. African production declined by 4.9% in 2024 but is expected to grow by 2.5% in the coming year.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/checkout/5888

Nickel Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 48.19 billion |

| Revenue forecast in 2034 | USD 84.49 billion |

| Growth rate | CAGR of 7.27% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative Units | Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2034 |

| Report coverage | Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

| Segments covered | By Product Type, By End-Use Industry, By Region |

| Regional scope | North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; U.K.; France; Russia; China; Japan; India; South Korea; Brazil; South Africa |

| Key companies profiled | Sumitomo Metal Mining Co., Ltd. , Anglo American Plc , Xstrata PLC , Sherritt International Corporation , Eramet Group , Zhejiang Huayou Cobalt Co., Ltd. , MMC Norilsk Nickel , Pan American Silver Corp. , China Nickel Resources Limited , First Quantum Minerals Ltd. , Jiangsu Yunnan Tin Company Limited , Inco Limited , Korea Zinc Co. Ltd. , Itronics Inc. , SMM (Sumitomo Metal Mining ) |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Weak demand weighs on nickel sulfate

The battery sector contributed to about 384,000 mt Ni, 11.5% of the global primary nickel consumption in 2024, according to Commodity Insights. Although it is expected to increase to 543,000 mt Ni, making up 15.2% of 2025's global consumption, nickel sulfate prices are likely to remain weak due to underutilized mixed hydroxide precipitate-to-sulfate capacity.

China's CNGR announced that it would pause investment in the South Korean nickel smelting project. Chinese nickel sulfate prices were rangebound throughout Q1, fluctuating between Yuan 25,200-27,700/mton slower demand and shifting battery preferences. Prices rose in March, supported by high production costs and higher MHP feedstock payables.

Platts, part of Commodity Insights, assessed spot battery-grade nickel sulfate with a minimum 22% nickel content and maximum 100 ppb magnetic material at Yuan 27,100/mt ($3,759/mt) DDP China April 11, up 7.5% since the start of Q1.

MHP payables continued to rise throughout Q1 on tighter supply. Nickel and cobalt-containing MHP saw increased demand amid a four-month export ban of cobalt from the Democratic Republic of Congo, further tightening supply despite increased capacity and production from Indonesia.

As the largest MHP supplier to China, Indonesia's MHP exports to China rose 72.3% year over year to 258,709 mt in January-February, 92.1% of China's total imports, Chinese customs data showed.

Platts assessed the MHP CIF North Asia basis LME nickel price at 84% payables April 11, up 4% since Jan. 2.

The all-in price, as calculated from the payables basis of the LME nickel price, was at $13,481/mt, up $1,108 since the start of Q1.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5888

Proposed Indonesian nickel royalty changes lift prices

Indonesia's Ministry of Energy and Mineral Resources proposed to increase royalty rates and non-tax state revenues for mineral and coal commodities at a public consultation March 8, which will take effect in April in an announcement a month later.

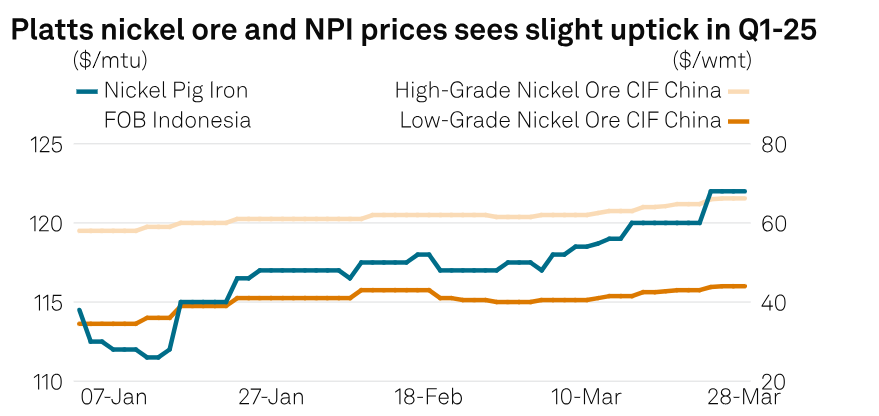

Higher royalties were proposed for nickel ore from 14% to 19% alongside other nickel products like nickel matte, NPI and ferronickel. Toward the end of Q1, market expectations were adjusted for potential cost increases.

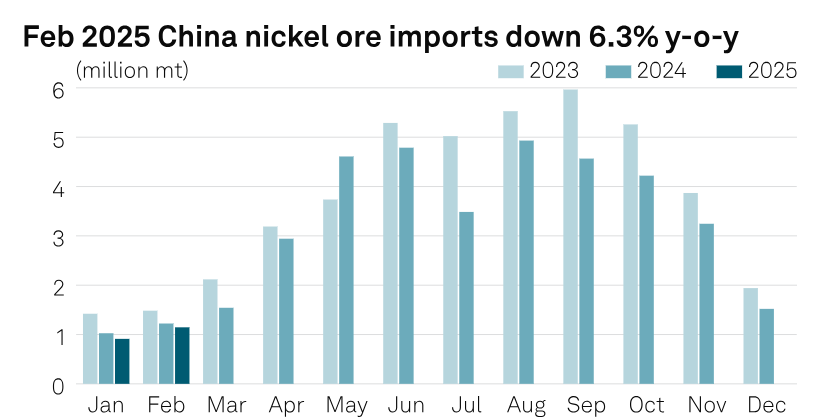

Upstream, nickel ore prices rose throughout Q1, with limited gains expected in Q2. As the Philippines' rainy season ends, more shipments are expected to reach China, and improved NPI margins have sparked buying interest in China.

However, NPI prices might struggle to maintain gains in Q2 on slow prevailing stainless steel demand.

Indonesian nickel ore premiums remain a key focus, as these fluctuations could affect Philippine nickel ore export prices and China's overall nickel supply chain.

Platts assessed daily spot NPI with 10% nickel content at $117.5/mtu FOB Indonesia April 11, up 2.5% since the start of Q1.

Low-grade nickel ore prices rose 28% in Q1 to the highest at $44/wmt March 26, while high-grade nickel ore prices also rose 14% to the highest at $66.2/wmt March 26.

Platts assessed low-grade nickel ore with 1.3% nickel content at $43.3/wmt CIF China and high-grade nickel ore with 1.6% nickel content at $65.5/wmt CIF China April 11, up 26% and 12.9%, respectively, from the start of Q1.

What Are The Major Trends In The Nickel Market?

- The rise of electric vehicle and energy storage demand pushing nickel producers to shift focus battery grade nickel and refine supply chains accordingly.

- Asia is consolidating its dominance in nickel production and processing, reinforcing regional control over upstream, and downstream, va;ue chains.

- The stainless steel sector remains a foundational pillar of nickel consumption, while nickel use in specialty alloys and plating is aiming more strategic importance.

- Regulatory pressures and environmental sustainability concerns are driving investments in low carbon nickel production, recycling and responsible sourcing.

Policy-driven shifts in the nickel market

In recent years, national policies have played an increasingly influential role in reshaping the global nickel market. Governments across key producing and consuming regions have introduced regulatory measures, trade restrictions, and investment incentives that have modified supply chains and altered market dynamics.

Indonesia’s policy framework has had a particularly significant impact on the global nickel sector. By banning the export of unprocessed ore, the government has aimed to promote domestic value addition by attracting investment in refining and in downstream industries such as STS and battery production. The introduction of the mining quota approval system (RKAB) has further tightened control over production volumes, influencing supply dynamics. Recent revisions to the royalty structure – including differentiated rates based on processing levels – are intended to enhance industry governance and improve the long-term management of the country’s nickel reserves. These revised royalties are expected to raise production costs. China’s policies, both at the national and international level, have had a considerable impact on the global nickel market. Domestically, the Chinese government has prioritised securing domestic nickel production and broader access to critical raw materials, alongside advancing the development of downstream industries. It has supported the growth of the EV industry, battery sector, and recycling through a combination of coordinated industrial and environmental policies, technological innovation, and sustained support for the domestic automotive sector. Ambitious targets for EV adoption and emissions reduction have also been set. Battery recycling is expanding, driven by both environmental goals and the need to strengthen resource security. Internationally, China has actively worked to secure nickel resources and expand its presence across the value chain.

Chinese firms have invested in overseas mining and refining – particularly in Indonesia –establishing integrated hubs for nickel, stainless steel, and battery material production. These investments reduce dependence on external suppliers and reinforce China’s strategic position in the global nickel market.

In February 2025, the Philippines introduced a bill to ban raw nickel ore exports, aiming to capture greater economic benefit from its mineral resources through domestic value-added processing. The move seeks to replicate neighbouring Indonesia’s success in developing its downstream nickel industry. However, industry stakeholders argue that the country may lack the infrastructure, affordable energy, and regulatory stability needed to support a competitive domestic processing sector, and that unless these fundamental challenges are addressed, the ban could result in mine closures, job losses, and reduced government revenues.

Both the European Union (EU) and the United States (US) are becoming increasingly active in securing critical raw materials and promoting sustainable industrial development. These efforts aim to reduce dependency on external suppliers, strengthen supply chain resilience, and encourage investment in domestic refining and recycling capacity. Growing emphasis is also being placed on environmental and social governance (ESG) standards, which may influence trade flows and sourcing decisions.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5888

How Does AI Influence The Growth Of The Nickel Market In 2025?

In 2025, AI is shaping the nickel market by optimizing every stage of the value chain from exploration and mine planning to extraction and processing thus reducing waste and improving yield; it enables predictive maintenance of equipment and autonomous operations in mines, lowering downtime and operational costs: AI driven analytics enhance forecasting of supply, demand an pricing dynamics, making strategic investment decision sharper, and the use of AI in ESG, monitoring and resource management boosts the appeal of nickel projects with lower carbon footprints. Aligning them with sustainability goals and attracting new capital.

Here Are Some Of The Top Products In The Nickel Market

1. Class I Nickel

- High-purity nickel (≥99.8%), used in batteries, electronics, and specialty alloys.

2. Class II Nickel

- Lower-purity nickel (includes ferronickel and nickel pig iron), mainly used in stainless steel.

3. Ferronickel

- Iron-nickel alloy with ~20–40% nickel; widely used in stainless steel production.

4. Nickel Pig Iron (NPI)

- Low-grade, cost-effective nickel-iron alloy; primarily used in China for stainless steel.

5. Nickel Sulfate

- Essential chemical for lithium-ion battery cathodes in EVs.

6. Nickel Matte

- Intermediate product (often from laterite ores); processed into Class I nickel or sulfate.

7. Nickel Oxide

- Used in ceramics, catalysts, and as a precursor in electroplating and battery materials.

8. Nickel Alloys (e.g., Inconel, Monel)

- High-performance alloys for aerospace, marine, and chemical industries.

9. Electrolytic Nickel (Nickel Cathode)

- Pure nickel sheets used in electroplating and alloy production.

10. Nickel Powder

- Finely divided nickel for electronics, batteries, 3D printing, and catalysts.

Nickel Market Dynamics

Growth Factors

Could EV Battery Demand Drive Nickel’s Surge?

Demand for nickel in electric vehicle batteries I pushing the industry to shift toward higher purity, battery grade materials and invest in refining capacity to meet new performance requirements.

Can Recycling Turn Waste Into A Growth Engine?

Growing emphasis on recycling end is life batteries and nickel containing materials is creating a more circular supply chain and reducing reliance on primary mining, making nickel more sustainable and attractive.

Market Opportunity

Could Drone Based Exploration Open New Nickel Fields?

The adoption of advanced drone and AI technologies in mineral exploration enables companies to survey vast terrains more efficiently and pinpoint high potential nickel cones faster, thereby lowering exploration costs and accelerating project timelines.

Might Nuclear Batteries Reinvent Nickel Use?

The development of nickel 63 nuclear batteries which convert radioactive decay into electricity offers a novel application that could boost demand for nickel isotopes in sectors like remote sensors, space systems, and medical implants as these power sources gain traction.

Limitations In The Nickel Market

- High capital intensity and heavy upfront investment pose a barrier for new mine development and proceeding capacity expansion.

- Environmental regulations and permitting constraints restrict operations in sensitive region and slow project progression.

Nickel Market Segmentation Insights

Product Type Insights

Which Product Type Dominates the Nickel Market?

The refined nickel segment dominated the market in 2024, driven by its essential role in producing high quality alloys and stainless steel. Refined nickel’s versatility makes it indispensable across various industries, including aerospace, automotive, and energy sectors. Its superior purity levels ensure enhanced performance and durability in critical applications, further solidifying its market position. The increasing demand for advanced materials in emerging technologies continues to bolster the refined nickel segment’s prominence. As industries evolve, the refined nickel segment remains a cornerstone of the market.

The nickel sulphate segment is projected to grow at the fastest rate in the market during the forecast period, primarily due to its pivotal role in the production of lithium-ion batteries. As the demand for electric vehicles and renewable energy storage solutions escalates, the need for high purity nickel has surged. This growth is further fuelled by technological advancements in battery manufacturing and an increasing shift towards sustainable energy sources. The nickel sulphate segment’s expansion reflects the broader transition towards electrification and green technologies. Its rapid growth underscores the evolving dynamics of the market.

End Use Industry Insights

Which End Use Industry Dominates Nickel Market?

The stainless-steel production segment dominated the nickel market in 2024, accounting for a substantial share due to nickel’s critical role in enhancing corrosion resistance and strength in stainless steel alloys. The construction, automotive, and infrastructure, sector’s robust growth has significantly contributed to the increased demand for stainless steel. Nickel’s unique properties make it indispensable in producing durable and high-performance stainless-steel products. As industrialization continues globally, the stainless-steel production segment’s dominance in the market is expected to persist. This enduring demand underscores the fundamental importance of nickel in modern manufacturing.

The automotive sector is anticipated to be the fastest growing in the market during the forecast period, driven by the accelerating adoption of electric vehicles (EVs). Nickel is a crucial component in EV batteries, particularly in high energy density cathodes, making it essential for the burgeoning EV market. The global shift towards sustainable transportation solutions has spurred significant investments in EV production, thereby increasing the demand for nickel. This trend reflects the automotive industry’s pivotal role in the transition to cleaner energy sources.

Regional Insights

Why Is Asia Pacific The Dominant Force In The Nickel Market?

Asia Pacific dominated the global nickel market in 2024, driven by rapid industrialization and robust infrastructure development. Countries like China, Indonesia, and the Philippines play pivotal roles in nickel production, with Indonesia alone accounting for over half of the global output. The region’s substantial investments in battery production, particularly for electric vehicles, have further intensified the demand for high purity nickel, particularly for electric vehicles, have further intensified the demand for high purity nickel. Additionally, the prevalence in laterite nickel deposits in countries such as Indonesia and the Philippines has facilitated the region’s dominance in nickel mining. This strategic positioning underscores Asia Pacific’s critical rile in shaping the future of nickel industry.

What Factor’s Contribute To Europe’s Growing Influence In The Nickel Market?

Europe is expected to register the fastest growth during the forecast period, fuelled by increasing demand form sectors like electric vehicles and stainless-steel production. Countries such as Germany and France are at the forefront of adopting electric vehicle technologies, driving the need for nickel in battery production. Moreover, Europe’s commitment to decarbonisation and sustainable practices has led to advancements in battery technology, further boosting nickel demand. Despite challenges like declining production in certain regions, Europe’s strategic investment in innovation and sustainability are enhancing its position in the market.

Nickel Market Top Companies

- Sumitomo Metal Mining – Major producer of refined nickel and nickel sulfate for EV batteries, mainly in Japan and Philippines.

- Anglo American – Produces nickel from its Barro Alto and Codemin mines in Brazil; key supplier for stainless steel and battery sectors.

- Xstrata (now Glencore) – Significant nickel producer through global operations; merged with Glencore in 2013.

- Sherritt International – Joint ventures in Cuba and Madagascar; focuses on laterite nickel production.

- Eramet – Operates the SLN nickel plant in New Caledonia; produces ferronickel.

- Huayou Cobalt – Expanding into nickel mining in Indonesia for battery-grade nickel.

- Norilsk Nickel – World's top nickel producer; dominates global high-grade nickel supply.

- China Nickel Resources – Imports nickel ore and produces nickel pig iron for steel.

-

First Quantum – Produces nickel at Ravensthorpe (Australia) and Enterprise (Zambia).

More Insights in Towards Chemical and Materials:

- Green Chemicals Market : The global green chemicals market size was valued at USD 13.85 billion in 2024 and is expected to hit around USD 29.49 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.85% over the forecast period from 2025 to 2034.

- Waterproofing Chemicals Market ; The waterproofing chemicals market size accounted for USD 7.85 billion in 2024 and is predicted to increase from USD 8.39 billion in 2025 to approximately USD 15.23 billion by 2034, expanding at a CAGR of 6.85% from 2025 to 2034.

- Commodity Chemicals Market : The global commodity chemicals market size was valued at USD 813.85 billion in 2024, grew to USD 867.97 billion in 2025, and is expected to hit around USD 1,549.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.65% over the forecast period from 2025 to 2034.

- Electronic Materials And Chemicals Market : The global electronic materials and chemicals market size was valued at USD 74.19 billion in 2024 and is expected to hit around USD 136.03 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.25% over the forecast period from 2025 to 2034.

- Textile Chemicals Market : The global textile chemicals market volume is expected to produce approximately 1.52 million tons in 2025, with a forecasted increase to 2.46 million tons by 2034, growing at a CAGR of 5.49% from 2025 to 2034.

- Lithium Chemicals Market : The global lithium chemicals market size was reached at USD 33.19 billion in 2024 and is expected to be worth around USD 196.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 50% over the forecast period 2025 to 2034.

- Sustainability Chemical Market ; The global sustainability chemical market size was reached at USD 80.77 billion in 2024 and is expected to be worth around USD 161.73 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.19% over the forecast period 2025 to 2034.

- Bio-Based Platform Chemicals Market : The global bio-based platform chemicals market size was reached at USD 29.33 billion in 2024 and is expected to be worth around USD 48.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.15% over the forecast period 2025 to 2034.

- Construction Chemicals Market : The global construction chemicals market size is calculated at USD 51.19 billion in 2024, grew to USD 53.02 billion in 2025 and is predicted to hit around USD 72.7 billion by 2034, expanding at healthy CAGR of 3.57% between 2025 and 2034.

Nickel Market Top Key Companies:

- Sumitomo Metal Mining Co., Ltd.

- Anglo American Plc

- Xstrata PLC

- Sherritt International Corporation

- Eramet Group

- Zhejiang Huayou Cobalt Co., Ltd.

- MMC Norilsk Nickel

- Pan American Silver Corp.

- China Nickel Resources Limited

- First Quantum Minerals Ltd.

- Jiangsu Yunnan Tin Company Limited

- Inco Limited

- Korea Zinc Co. Ltd.

- Itronics Inc.

- SMM (Sumitomo Metal Mining

Recent Development

- In July 2025, BHP Group has divested opts 17% stake in the Kabanga Nickel Project in Tanzania to partner Life zone Metals for up to $83 million. This decision reflects BHP’s strategic shift due to a surplus of nickel production from Indonesia and a weekend market outlook. The move also follows BHP’s suspension of its Australian Nickel West operations, highlighting the company’s revaluation of its nickel portfolio.

- In February 2025, Anglo American has finalized the sale of its nickel operations in Brazil to MMG Singapore Resources for up to $500 million. The transaction includes ferronickel operations and greenfield projects, aligning with Anglo American’s strategy to focus on copper and iron ore mining.

Nickel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Nickel Market

By Product Type

- Nickel Ore

- Nickel Pig Iron (NPI)

- Nickel Sulphate

- Nickel Carbonate

- Nickel Matte

- Refined Nickel

- Class I Nickel

- Class II Nickel

By End-Use Industry

- Stainless Steel Production

- Flat Products

- Long Products

- Batteries

- Nickel-Cobalt-Aluminum (NCA) Batteries

- Nickel-Manganese-Cobalt (NMC) Batteries

- Electronics

- Semiconductors

- Circuit Boards

- Automotive

- Electric Vehicles (EV)

- Energy Storage

- Grid Storage

- Batteries for Renewable Energy

- Plating and Coatings

- Aerospace

- Chemical Industry

- Catalysts

- Electroplating

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5888

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.